HOUSING MARKET OUTLOOK 2026:

KEY RISKS, POLICY SHIFTS, AND WHAT COMES NEXT

via themortgagepoint.com—As the housing market heads into 2026, affordability challenges, insurance-market stress, and shifting credit conditions are converging with a rapidly changing policy landscape. To better understand the forces that will shape housing and mortgage finance in the year ahead, MortgagePoint spoke with John Comeau, Policy Economist at the Council of Federal Home Loan Banks.

You can read our full cover story in the November edition of MortgagePoint, but in this Q&A excerpt, Comeau explores the underappreciated risks, policy levers, and market dynamics that industry leaders should be watching closely.

From a policy perspective, what are the most underappreciated regulatory or legislative issues that could impact the housing and mortgage markets in 2026 (e.g., GSE reform, affordable-housing tax credits, servicing regulation)?

Home prices, property taxes, rents, and insurance premiums are all near record highs, while mortgage rates have hovered between 6% and 7% since late 2022—roughly double the 3% range of 2020–2021. As we enter 2026, affordability challenges will remain front and center, driven by a shortage of housing supply. Federal housing policy levers have traditionally focused on the demand side rather than on supply. The omnibus economic and housing package passed by Congress in 2025 expanded Low-Income Housing Tax Credit (LIHTC) allocations, established a middle-income housing tax credit, and sought to streamline permitting and incentivize infill development, all beginning in 2026. All of these measures are intended to positively impact the supply side of the equation. In 2026, I will be watching to see the impact of the changes—especially LIHTC, as the other two will have longer implementation timelines—on the nation’s housing supply.

I will also be watching the property insurance market. Wildfires, hurricanes, and other extreme weather events have driven premiums and loss rates higher, causing insurers to withdraw from high-risk geographies despite rate hikes. In 2025, discussion of capping insurance premium increases has increased among state legislators and regulators. While well-intentioned, the measures could …READ MORE

DISCOVER MIAMI SPRINGS!

We are committed to providing a premier level of

service.

All aspects of your real estate experience will be accompanied by Results through exceptional Service and Honesty. From the onset of our marketing meeting, we are dedicated to achieve your goals.

The Current Miami Springs Market

DEMAND IS STILL THERE DESPITE HIGHER INTEREST RATES

The Miami Springs/Virginia Gardens market recently saw an almost a fifteen-percent (15%) increase in inventory!! There are forty (40) active listings. There are still qualified buyers looking for the right property despite slower demand. Sellers are seeing more price decreases, but high prices remain. Properties are staying on the market for longer but some houses still sell quickly. The Market has been unusual but the right house is still out there. It all depends on pricing, condition, location, and of course, timing. Timing is everything.

There are sixteen (16) active listings over $1 million. Nineteen (19) of the active listings have had a price reduction, two (2) this week. Days on the market (DOM) is averaging around 91. Mortgage interest rates have been fluctuating between 6-6.5%. An additional rate cut before the end of the year is unlikely.

Inventory Breakdown:

There is one (1) property under $600,000; eight (8) properties are priced between $600,000-$700,000; seven (7) between $700,000-$800,000; six (6) between $800,000-$900,000; two (2) are priced between $900,000-$1,000,000; sixteen (16) between $1-2 million; and none (0) are listed for over $2 million.

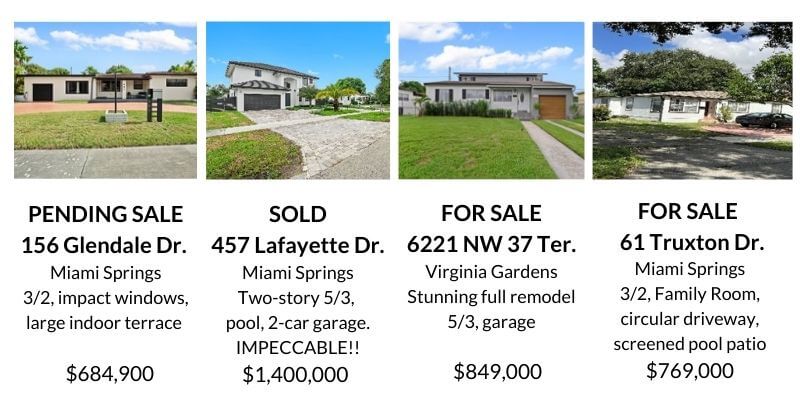

CALL US FOR AN EVALUATION

During the period of November 14, 2025 through November 21, 2025, there were reported 0 new listings, 1 closed sale, 1 pending sale, 2 active with contract, 1 expired listing, 0 cancelled listings, 1 temp off market, 2 price reductions, and 0 price increases.

HOW DOES YOUR HOUSE COMPARE?

The table below shows the current status of the Miami Springs/VG real estate market as of November 21, 2025. All closed sales are within the last 90 days.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

A complete list of all the properties for sale in Miami Springs or any other area of Miami-Dade County can be sent to you on regular basis. Request it at: charlie@leonardrealestategroup.com

………………………………………………..……………………………………………………………………………

We are the Miami Springs Experts

however, we service all of South Florida

Let Us Show You How We Can Get Your Property Sold

at the Highest Possible Price

Attention Sellers!

What are You Waiting For?

We can provide you with a market analysis so you can see how much your property is worth.

Honesty | Service | Results

Drop by to see us

190 Westward Drive

or call us 305-726-8416

Appointments available upon request

Beautiful Miami Springs. Tree City USA.

Our secret paradise in Miami Dade County!

STAY INFORMED!

Thank You

Charlie 305-726-8416