U.S. Housing Demand Softens Amid Rising Inventories

via themortgagepoint.com—With supply continuously improving and demand continuing to be weak, December marked the end of a slow and difficult year for the US housing market. Active listings in December increased 12.1% year-over-year (YoY) but down 8.9% month-over-month (MoM), as is typical at this time of year, according to Realtor.com housing data. Homes took longer to sell (+4 days YoY), new listings decreased (YoY and MoM), and prices continued to decline countrywide, with the median list price down 0.6% from the previous year. Regional disparities continued to be glaring behind the national headline trends.

While the Midwest and Northeast continued to lag below pre-pandemic supply levels, the South and West had the strongest inventory recovery; prices (per square foot) rose in the Northeast (+4.1% YoY) and Midwest (+1.7%) while declining in the South (-2.3%) and West (-1.4%). After what was largely a frustrating year for both buyers and sellers, Realtor.com anticipates a slight improvement in 2026—lower mortgage rates, more inventory, and a gradual stride toward better balance.

By separating benchmark markets, or “benchmarkets,” that determine regional housing patterns from “outlier” markets that defy them, this month’s analysis takes a fresh look toward 2025. In the housing industry, extremely local supply and demand dynamics are often overlooked by national and regional averages. In order to address that, we compare metro areas whose local idiosyncratic dynamics predominate with those whose inventory and price changes closely mirror those of their larger region.

The findings highlight the actual inequality of 2025. Certain markets consistently conveyed the regional narrative within each region, while others showed stark differences. These distinctions are important for house purchasers, analysts, and politicians alike: if you live in an outlier market, headline regional narratives may be deceptive. However, striking local tales aren’t usually indicative of more general circumstances. Knowing which metro areas serve as dependable indicators and which are anomalies as the market moves into 2026 makes it easier to see where…READ MORE

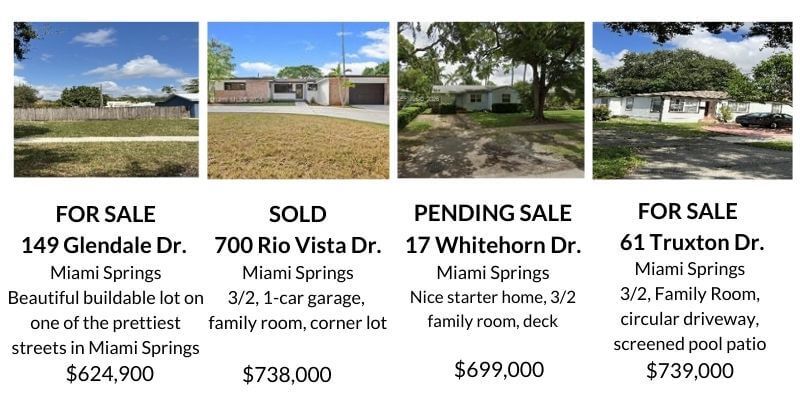

DISCOVER MIAMI SPRINGS!

We are committed to providing a premier level of

service.

All aspects of your real estate experience will be accompanied by Results through exceptional Service and Honesty. From the onset of our marketing meeting, we are dedicated to achieve your goals.

The Current Miami Springs Market

DEMAND IS STILL THERE DESPITE HIGHER INTEREST RATES

WOW!! 2025 ended with a $2,130,000 SALE. The property at 549 East Dr SOLD FOR CASH!!! There are 2 additional listings for over $2 million. One for more than $3 million. Will they sell for those prices??? Time will tell.

I do believe Miami Springs is transitioning into more expensive market. Of the Thirty-eight (38) active listings in the MS/VG markets this week, eighteen (18) are over $1,000,000. Of those 2 are over two (2) million and one is asking close to four (4) million!!!!!

High prices remain and demand is still slow, but there are still qualified buyers out there. More increases in inventory in the months ahead?? I think so...

Mortgage Interest rates have decreased. Rates expected to continue to 5.8-6% this year. There are still qualified buyers looking for the right property. Timing is everything. Days on the market (DOM) are on average 61 days. Some houses sell quickly. It all depends on pricing, condition and location, location, location. The decrease in interest rates should result in increased sales activities. It is important to price the property right.

Inventory Breakdown:

There is one (1) property under $500,000; one (1) property is priced between $500,000-$600,000; five (5) properties are priced between $600,000-$700,000; ten (10) between $700,000-$800,000; two (2) between $800,000-$900,000; one (1) is priced between $900,000-$1,000,000; fifteen (15) between $1-2 million; two (2) are listed for over $2 million; and one (1) is listed for over $3million.

CALL US FOR AN EVALUATION

During the period of January 16, 2026 through January 23, 2026, there were reported 2 new listings, 2 closed sales, 2 pending sales, 2 active with contract, 2 expired listings, 4 cancelled listings, 0 temp off market, 4 price reductions, and 0 price increases.

HOW DOES YOUR HOUSE COMPARE?

The table below shows the current status of the Miami Springs/VG real estate market as of January 23, 2026. All closed sales are within the last 90 days.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

A complete list of all the properties for sale in Miami Springs or any other area of Miami-Dade County can be sent to you on regular basis. Request it at: charlie@leonardrealestategroup.com

………………………………………………..……………………………………………………………………………

We are the Miami Springs Experts

however, we service all of South Florida

Let Us Show You How We Can Get Your Property Sold

at the Highest Possible Price

Attention Sellers!

What are You Waiting For?

We can provide you with a market analysis so you can see how much your property is worth.

Honesty | Service | Results

Drop by to see us

190 Westward Drive

or call us 305-726-8416

Appointments available upon request

Beautiful Miami Springs. Tree City USA.

Our secret paradise in Miami Dade County!

STAY INFORMED!

Thank You

Charlie 305-726-8416