MORE HOUSING MARKET OUTLOOK 2026: RESETS, RISKS, AND ROAD TO RECOVERY

via themortgagepoint.com—In this excerpt from our full November cover story, Rick Sharga, Founder and CEO of CJ Patrick Company, offers a sweeping analysis of where the housing market stands as 2026 approaches. From his view of a five-year “reset” to the latest signals on delinquencies, investor activity, demographic pressure, and policy risks, Sharga breaks down the economic forces and industry blind spots that will shape the year ahead.

How would you characterize the housing market heading into 2026: correction, stabilization, or early recovery?

I believe that we’re in the third year of a five-year “reset” period, as the market slowly adjusts to higher prices and higher mortgage rates. We’ve never had a period where home prices rose by over 40%, followed by mortgage interest rates doubling, and that one-two punch decimated affordability, especially for first-time buyers. Existing home sales fell from over six million in 2021 to five million in 2022, four million in 2023 and 2024, and are on pace to finish the year at about the same number this year. Inventory levels are rising, days on market increasing, and home price appreciation slowing down—and reversing course, in some markets—as wages grow. We can probably expect another year of lackluster sales and price growth in 2026, but the market should begin to recover as we move closer to 2027.

With affordability still strained and inventory tight, do you see transaction volumes improving next year or remaining near historic lows?

I think 2026 sales volume will be modestly better than 2025, but not much more than that. Barring anything extraordinary happening in the economy, either positive or negative—we’ll likely have at least one more year where existing home sales will be challenged to go much higher than four million units, and where home price appreciation will continue to slow down in most markets and go negative in some parts of the country. Inventory will continue to increase, though, at least partly due to the pace of sales slowing down, and some older homeowners deciding it’s time to downsize.

What do the latest foreclosure and delinquency trends suggest about borrower health going into 2026?

Mortgage delinquency rates continue to stay below historical averages and are close to the lowest they’ve ever been. There’s a combination of factors at play here: the unemployment rate is still very low (and there’s a strong correlation between unemployment rates and mortgage delinquency rates); borrower credit quality has been excellent; millions of homeowners refinanced into lower interest rate loans, and so may be paying less every month today than when they first bought their house; and there’s a massive amount of homeowner equity—well over $34 trillion—that distressed …READ MORE

DISCOVER MIAMI SPRINGS!

We are committed to providing a premier level of

service.

All aspects of your real estate experience will be accompanied by Results through exceptional Service and Honesty. From the onset of our marketing meeting, we are dedicated to achieve your goals.

The Current Miami Springs Market

DEMAND IS STILL THERE DESPITE HIGHER INTEREST RATES

There are thirty-nine (39) active listings in the Miami Springs/Virginia Gardens market. Demand has slowed and high prices remain, but we are seeing more price decreases on active listings. Of this week's active listings, there have been eighteen price reductions, two this week. There is much uncertainty but there are still qualified buyers looking for the right property. The right house is still out there. It all depends on pricing, condition, location, and of course, timing. Timing is everything!

There are fifteen (15) active listings over $1 million. Days on the market (DOM) is averaging around 91. Mortgage interest rates are expected to fluctuate between 6-6.5% the rest of the year. A significant rate cut before the end of the year is unlikely.

Inventory Breakdown:

There is one (1) property under $600,000; six (6) properties are priced between $600,000-$700,000; eight (8) between $700,000-$800,000; seven (7) between $800,000-$900,000; two (2) are priced between $900,000-$1,000,000; fifteen (15) between $1-2 million; and none (0) are listed for over $2 million.

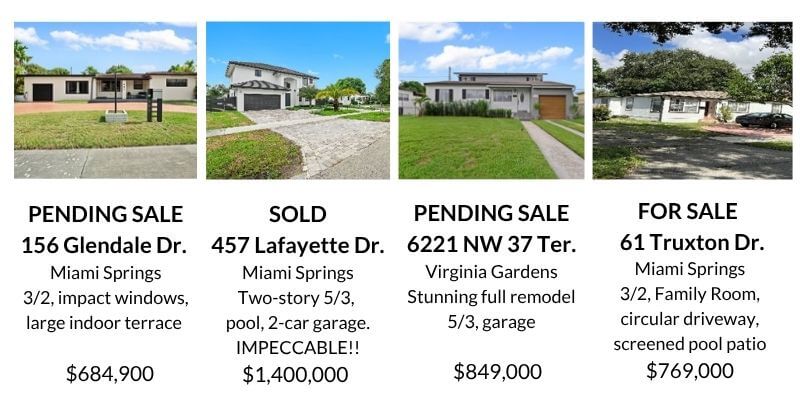

CALL US FOR AN EVALUATION

During the period of November 21, 2025 through November 28, 2025, there were reported 2 new listings, 3 closed sales, 1 pending sale, 1 active with contract, 0 expired listings, 1 cancelled listing, 0 temp off market, 2 price reductions, and 0 price increases.

HOW DOES YOUR HOUSE COMPARE?

The table below shows the current status of the Miami Springs/VG real estate market as of November 28, 2025. All closed sales are within the last 90 days.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

*Disclaimer: The data relating to real estate displayed on this website and the chart above comes from the Miami Board of Realtors MLS. All listing information is deemed reliable but not guaranteed and can be independently verified.

A complete list of all the properties for sale in Miami Springs or any other area of Miami-Dade County can be sent to you on regular basis. Request it at: charlie@leonardrealestategroup.com

………………………………………………..……………………………………………………………………………

We are the Miami Springs Experts

however, we service all of South Florida

Let Us Show You How We Can Get Your Property Sold

at the Highest Possible Price

Attention Sellers!

What are You Waiting For?

We can provide you with a market analysis so you can see how much your property is worth.

Honesty | Service | Results

Drop by to see us

190 Westward Drive

or call us 305-726-8416

Appointments available upon request

Beautiful Miami Springs. Tree City USA.

Our secret paradise in Miami Dade County!

STAY INFORMED!

Thank You

Charlie 305-726-8416